Quick! See how fast you can help those who want solar achieve their goals by encouraging an extension of this extremely popular incentive. Take a few seconds to ask your state's representatives to extend the solar Investment Tax Credit, also called the ITC, before it decreases in 2020.

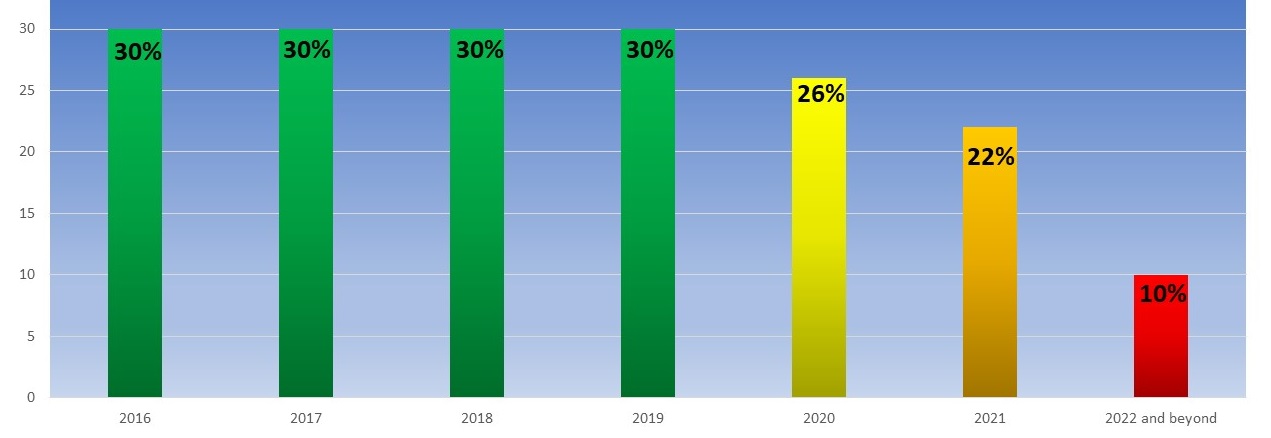

In effect since 2016, the solar Investment Tax Credit has been one of the most successful clean energy policies ever passed. It allows home and business owners to receive a dollar-for-dollar reduction of income tax owed when they install solar. 30% of the solar project cost, including permitting, equipment and installation, can be claimed on their Federal tax return in 2019, then it steps down to 26% in 2020.

An extension of the ITC would help homeowners and business owners cover the cost of solar, and create jobs. According to 10-year forecasts released by the Solar Energy Industries Association (SEIA) and Wood Mackenzie Power & Renewables, an extension of the solar Investment Tax Credit would spark $87 billion in new private sector investment and add 113,000 American jobs (over baseline estimates) by 2030.

[]

[]

Bipartisan legislation has been introduced that calls for a five-year extension of the solar ITC. CALSSA, the California Solar + Storage Association, has made it easy for anyone who wants to ask their representatives to vote to extend the legislation. If you follow the link below, you'll find a very short form to fill out, and a well written message for you to send. You can reword it if you'd like, but we feel this pretty much says it all:

"As a constituent in your district, I'm writing to ask you to cosponsor bipartisan legislation extending the solar investment tax credit (H.R. 3961). The Solar ITC has supported hundreds of thousands of jobs, and is one of the most effective tools we have to support the growth of clean energy in the U.S.

H.R. 3961, the Renewable Energy Extension Act, would extend the credit for 5 years and is led by Rep. Mike Thompson (D-CA) and Rep. Paul Cook (R-CA). It has more than 40 cosponsors across both parties, and enjoys broad public support.

Investment and development of solar energy in the United States continues to grow, and the Investment Tax Credit is the bedrock of this growth. The ITC is a proven policy that will support clean energy development, grow the economy, create jobs, and meaningfully cut emissions.

With your support, an extension of the solar investment tax credit will enable the industry to continue to create new careers for Americans, deliver clean electricity across the nation, and bolster reliable and affordable energy options.

I hope I can count on you to cosponsor this important legislation and urge House Leadership to include an extension of the solar ITC in any end-of-year negotiations."

To ask your representatives to support the extension of ITC, click here. Type in your name. Add your zip code and the system will automatically find your representatives for you. Add your email address. Click OK to send it. Everyone at Sun Light & Power thanks you!

To find out how your business could save money on solar through the ITC, contact us at www.sunlightandpower.com.

Get out your stopwatch, and GO! #defendtheITC